Join a Syndicate of Acquisitions Experts and Passively Multiply Your Net Worth

The chance to invest in multiple profitable businesses alongside the largest community of mergers and acquisitions entrepreneurs in the world

Trusted by

Our strategy gives accredited investors access to tremendous deal flow that is traditionally limited to very few of the wealthiest investors

Track Record

We have 100+ transactions in just the past 3 years

Winning Strategy

We only acquire profitable companies led by world-class founders

How It Works

What is Acquisitions.com?

We are a group of highly motivated M&A entrepreneurs. We know that over 90% of startups fail within the first 5 years. That's why we strongly believe that merging profitable and established businesses is the way forward.

We’ve been doing this for years, and as a result:

We built the largest community

of Mergers and Acquisitions entrepreneurs in the world

We receive thousands of applications from small business owners every year who want to work with us

Our Acquisitions Strategy

We buy smaller companies that have been profitable for years, consolidate them into one larger entity, optimize their internal operations, and take this entity public.

For Small Business Owners

They get to grow their business alongside experts and eventually go public with us

For Our Investors

They get to invest in a cherry picked portfolio of profitable companies with almost no downside

Our Current Focus

We are currently focused on acquiring and merging profitable companies in the digital marketing sector.

Why Digital Marketing?

The entire world is moving online after the lockdown

Demand for better online marketing will never stop

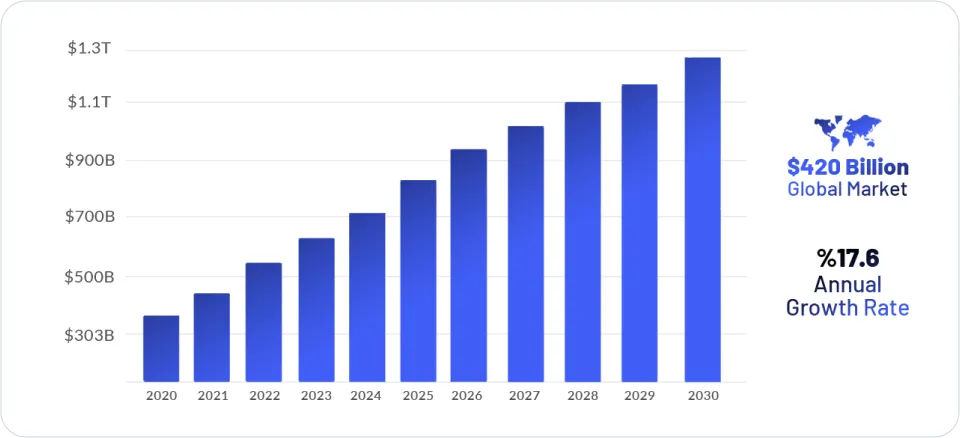

The industry is growing at a CAGR of 17.6% expected to reach $800B+ by 2026

Society is still only 13% digital which means the market is far from saturated

The Digital Marketing Industry

Our Unique Market Edge

How We Choose Companies

Our network gives us access to companies that have already been profitable for years and still have lots of potential

Why Companies Choose Us

We take the stress away from our partners by handling their operations while they focus on their creative expertise

By merging multiple profitable companies and allowing the founders to focus on what they’re great at, we both eliminate the downside and maximize the upside for our investors.

Why Now

Digital Marketing is expected to reach a $500 Billion market cap by the end of 2022 and close to a Trillion by 2026

All signs point toward the market going from horizontal to vertical very soon which is the best time to invest

Our Track Record

More than 120 deals closed

Deal size $500k-$40M

$550M in revenue

9 countries and over 25 industries

Meet the Founder

Moran Pober

Moran has founded, advised, sold, or played an integral role in the exits or acquisitions of over 100 companies, such as Werribee Panels, Forward Freight Systems, Rittenhouse Book Distribution, S4Films, Community Home Services and others.

Moran has 15+ years of entrepreneurial experience, served as a General Partner at WeKix Israel Venture Funds and acquired iTips Group.

As an entrepreneur, Pober has founded and acquired several companies, including a UK-based professional services firm, a US-based media, news and entertainment company, a Canadian based digital solutions Talonx.

Moran is now the founder and CEO of Acquisitions.com, a leading marketplace for buying and selling businesses with the vision of creating a world where anyone who has the drive and desire, can fulfill their dream of entrepreneurship, through acquisitions.

FAQ

What makes Acquisitions.com a better option than its competitors?

What separates us from our competitors isn’t just our dealflow, expansive network, and track record, but we cherry pick only the top-performing agencies in the industry to consolidate. These are already profitable businesses that are making maybe 2-5x on their own, but have the potential to make 20-30x as one company, all under the same accounts, going public. To have access to these kind of deals, these kind of returns, this kind of dealflow, you have to be an institutional or VC investor with the capabilities of writing a $5+ million cheque.

We’ve built the largest community of mergers and acquisition entrepreneurs around the world, which is something you won’t find anywhere else.

What returns can I expect from investing with Acquisitions.com?

With us, the sky’s the limit. We have 1000s of professionals in our community who are always scouting for the next hot deal on companies that we can 10x their valuation.

To put it simply, you can expect returns of 15+%, with no real limits, depending on the operating margins of the large publics.

Why is now the time to invest with Acquisitions.com?.

The digital marketing software market is about to go boom, it is about to go from a horizontal to near vertical. By the end of this year, the market is expected to be valued at $870 billion. By 2026? The market is expected to be valued at $1.3 trillion. In just 4 short years, the market’s value will skyrocket, increasing by over 50%. And the benefits you’ll be reaping from this market going boom will only be compounded by the fact that the market is only 13% saturated, so you’ll be getting in ahead of everyone else.

When do I start seeing returns?

You can start seeing returns relatively very early on. We’ve closed over 100 transactions in the past 3 years alone, and most of our companies see exits within 3 to 5 years.

Are You Looking To Protect and Multiply Your Capital?

As an investor, you're always aiming high, looking for a good return on your capital. But let me say that before even thinking about a return on your capital, you should be more concerned with the return of your capital.

You want to make sure that your money is well protected with founders who really know what they're doing, and an asset class that's bulletproof and is independent of the stock market volatility.

The asset class we decided to open up for investors is one with unlimited upside, but also very little downside by design.

Think about it; if you invest in a startup, then you already know that there's a 90% chance it fails within the first five years. This is just a reality you have to accept.

Then again, the 10% of startups that succeed usually go on to become household names. But are you willing to take such a risk?

What if there's a way to have the best of both worlds? That is; the upside potential of startups WITHOUT the inherent risk?

This is exactly what business acquisitions can offer you.

Now, if you don't know me, my name is Moran Pobar. I'm the founder and CEO of acquisitions.com and rollups.com.

In the last 3 years alone, we were involved in over 100 transactions, and we managed to build the largest community of M&A investors and entrepreneurs out there.

Our model is very simple; we acquire companies that are already established and have been profitable for years, merge them into one entity, and take that entity public.

We are effectively skipping the first few years of a company, which is a struggle phase, and we go directly to companies that already generate consistent profits, have product-market fit, and are well-established within their niche.

We're paying based on previous results, not based on future promises that the business might sell us.

And the beauty with those acquisitions, and in small businesses in general, is the fact that with enough discipline and accountability, there's practically no limit to how much we can grow those businesses, because we grow them by acquisitions, and at the same time, we really optimize the internal operation of each of those companies.

With business acquisitions, we create a win-win-win situation for everyone involved. Be it us, the business owners, or our investors.

In the past few years, we received thousands of applications from business owners who want to be acquired by Acquisitons.com, simply because they're tired of the operations side of the business and want to go back to focusing on their creativity and zone of genius, while we take care of the backend operations.

For this round, we're focused on acquiring profitable and established digital marketing companies. We want to acquire a diverse portfolio of companies in that space to make sure that we are ready for any cycle in the economy.

As an investor, this is a 100% passive investment on your end, you just have to trust that me and my team know what we're doing. Which we do.

So if you're ready to explore more and learn how business acquisitions can become a real game-changer for your portfolio, click below and let's talk about our upcoming acquisitions, and how you can start protecting your wealth.